An Economy Ripped Asunder

When a government undermines the very system it is intended to protect

On an afternoon in October 1987, I sat on the deck of my home overlooking Allsopp Park, a 75-acre wooded ravine in Little Rock’s Hillcrest neighborhood. Gazing at the clouds above, I felt an intense burning sensation rising from my stomach, continuing upwards into my diaphragm.

“Is this an ulcer?” I thought, wincing as the pain spread to my chest. “What if I’m dying?” Of course, it wasn’t an ulcer, nor was I dying. I later learned my reaction was common among those experiencing their first financial market collapse.

Each successive financial crisis became easier for me to bear. Come to think of it, I barely remember the collapse of Long Term Capital Management. The internet bubble is just a small blip in my memory. I look back on the fall of Bear Stearns and then Lehman Brothers with a sense of nostalgia.

"There's a term I coined when I was in the Treasury, iatrogenic volatility. latrogenic illness is when you go into a hospital and you catch an infection there. latrogenic volatility is when policymakers, whose role is to stabilize markets, destabilize them with their actions."

Former Treasury Secretary Larry Summers, in a 2021 interview with the Financial Times

History tells us that economic calamities, from the 17th-century Tulip Bubble to the 2008 collapse of the housing market, are the unintended consequences of unforeseen events. A few years ago, the collapse of global markets was a reaction to an once-in-a-century act of God; the Great Financial Crisis of 2008 was spawned by financial engineers who created a Frankenstein’s monster they could not control.

Eventually, governments step in, new policies are enacted, and the system repairs itself, moving forward until the next time things fall out of balance. This is the way it has always worked—until now.

Earlier this month, I was a guest speaker for an international business class at the University of North Carolina at Wilmington’s Cameron School of Business. I initially planned to discuss wealth inequality and share evidence that, in my view, shows that we are in a period that exceeds the excess of the Gilded Age. But the events of the past few weeks in the financial markets were impossible to ignore.

How bad is it?

Let’s put it this way: I have the dubious distinction of having witnessed multiple market collapses firsthand, from that day in October 1987 until I left the business in 2012. I was on a trading desk when the internet bubble burst, on 9/11, and during the implosion of the housing market in 2008. Still, I have never seen anything like what we’re currently experiencing.

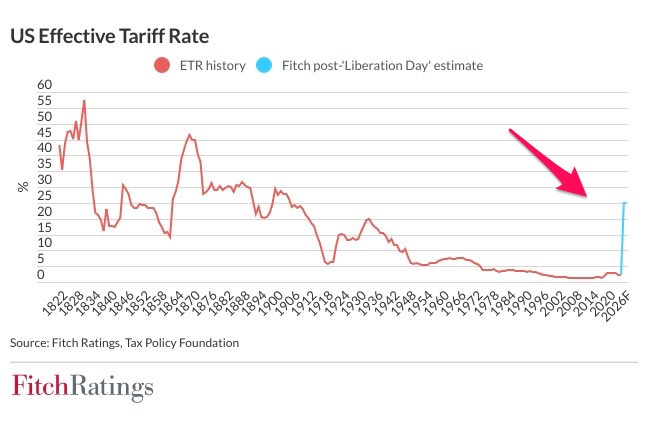

According to the Fitch rating service, tariffs are now at levels unseen since the early 1900s. And as the Wall Street Journal pointed out earlier this week, the Trump-induced stock market rout has the Dow Jones Industrial Average (DJIA) on track for its worst April since the Great Depression. The S&P 500’s performance is the worst for any president at this point in their term, going back to 1928.

In preparation for my talk, I came across a 2021 interview in the Financial Times with former Treasury Secretary Larry Summers. Summers used the word iatrogenic to describe the potential effects of pandemic stimulus checks. If I'm being honest, it was a word that sent me straight to the Merriam-Webster website.

Despite his status as a renowned economist, I’m not a huge fan of Larry Summers. He often comes off as a pompous ass who looks down his nose at the rest of us. I even wrote a piece once entitled, “Larry Summers is a Brilliant, Arrogant, Out-of-Touch Jerk.”

That being said, since the tariff announcement, I think Summers has been spot-on in his analysis of the effects of Trumpism on the political/financial order. In this Bloomberg interview, Summers explains the “iatrogenic” nature of Trump’s tariff hikes on the markets:

In addition to trillions in value evaporating from the stock market, something extraordinary happened following Trump’s so-called Liberation Day, the now-ignominious moniker President Donald Trump assigned to his April 2nd tariff announcement.

Conventional wisdom among global market participants is that the U.S. Treasury bond market, which is backed by the full faith and credit of the United States, is the safest place to invest money during uncertain times. Since treasury bonds are considered to carry the lowest level of investment risk on the planet, investors race to that market when things go awry. This phenomenon is referred to as a “flight to safety.”

Under normal conditions, U.S. Treasury bond prices move in opposition to the stock market indices. So when the Dow Jones Industrial Average (DJIA) and the Standard and Poor’s Index (S&P) fall, the treasury bond market rises in price, and conversely, interest rates on bonds decline.

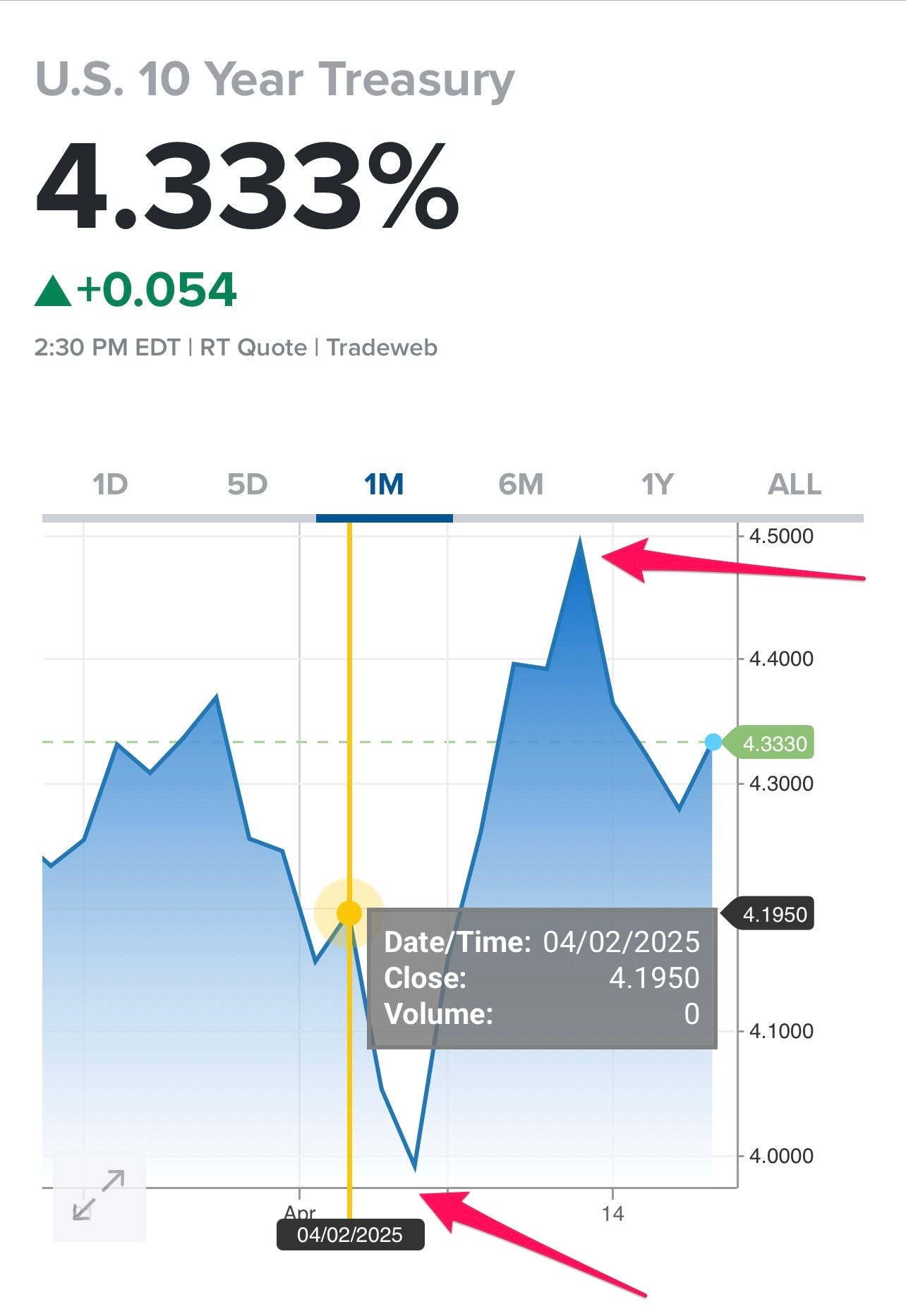

The (gigantic, sorry) chart below represents the yield on the benchmark 10-year T-bond. Note the initial decline in interest (the bottom arrow), reflecting the increase in price as investors rush to buy bonds after the announcement. But as the stock market continued its declines, instead of continuing to rise in price, bonds prices fall sharply, causing a spike in interest (the top arrow). This is the complete opposite of what happens under normal conditions.

T-bonds falling in tandem with the stock market (and the dollar) means sellers are fleeing the stock market and taking their money somewhere other than the place that heretofore was considered the safest place in the world. So why is this happening? The Wall Street Journal’s “Heard on the Street” column provides this ominous headline:

After the administration announced a 90-day pause in tariff increases, the Journal updated the headline. But on her intro the following evening on MSNBC’s “The 11th Hour,” Stephanie Ruhle, whose roots in finance trace back to her days covering hedge funds at Deutsch Bank, summarized the market’s reaction to the Trump administration’s tariff debacle:

Nearly a fortnight into the tariff pause, the White House has yet to announce significant progress on a single tariff deal. And so far, China’s response to three-digit tariffs has been to tell Trump to GTFO:

There’s something else to lose sleep over—the housing market. Mortgage rates are pegged to the interest rate on the 10-year Treasury. Unlike the days when banks held onto the mortgage loans they made, nowadays those loans go straight to Wall Street and are packaged into various mortgage-backed securities (MBS). As of January, foreign countries held a little over a trillion dollars worth of these bonds. China and Canada are among the countries holding most of that debt:

At the end of January, foreign countries owned $1.32 trillion worth of U.S. MBS, or 15% of the total outstanding, according to Ginnie Mae. The top owners: Japan, China, Taiwan and Canada.

China had already begun selling off some U.S. MBS last year, with the country’s holdings at the end of September down 8.7% year over year and down 20% by the start of December. Japan, which had shown gains in its MBS in September, showed a drop at the start of December.

If China and Japan were to accelerate those sales further, and if other nations were to follow, mortgage rates would rise even more than they are now.

What if China decides to unload their holdings in response to U.S. tariff policy? And what if other countries follow? Since Trump has pissed off the every non-authoritarian country on the planet, that’s not out of the realm of possibility.

Marlon I don't know why I gave this article a ❤️. It has scared the livin' crap out of me!

But keep doin what you doin', I appreciate you!

The MAGA movement, White Christian Nationalist and the Tech Lords are not concerned about economic collapse. They relish the thought of continued chaos. They represent the 37% that approves of this administration.

Under cover of chaos, they can take control of the country, regress laws back to 1895 and in the case of the Tech Lords set up a neo-feudalist regime with them as the lords of the manor.

They stupidly think the rest of the world will fall in line after their successful coup. The rest of the world has already moved on. Which means former US citizens will become 5th World subjects living in a dystopia that may take a generation or more to overthrow.