A Detail in Last Week’s Economic Reports You Might Have Missed

Sometimes good economic reports have little to do with what's happening now

The Journeyman’s content is offered without paywalls. To support free and accurate journalism, consider becoming a paid subscriber.

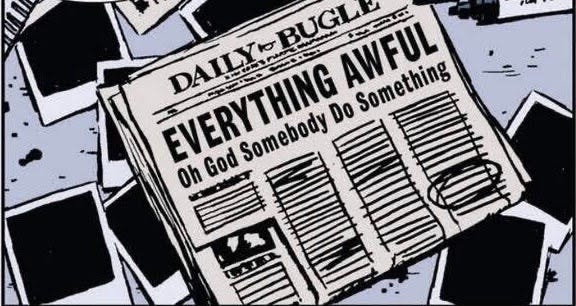

I ran across this Bloomberg clip this afternoon. It provides a stark picture of the level of economic uncertainty that lies ahead. As the economist in the video explains, the estimated cost of the Trump tariffs to global GDP is roughly two trillion dollars over the next three years. To put that in perspective, it’s the equivalent of subtracting the entire economic output of Russia, Italy, or Canada from the global economy.

But there’s something else that, in my opinion, the media hasn’t done a particularly good job of explaining to the public. The economic reports we’ve seen over the past week, like the one showing the first negative GDP years and unemployment, are backward-looking. They reflect a period in the past, not the current economic landscape. The economic reports we’ve seen thus far represent the “pre-Liberation Day” economy.

While there was an expectation of tariffs, no one—not even the experts—knew a) Trump would drop a tariff bomb on every country on the planet, or b) the tariffs would be the highest levels seen in a century. Think about what that means: Even though Trump’s tariffs weren’t announced until April 2nd, GDP for the quarter ending March 30th still dropped into negative territory for the first time in years. That is cause for concern.

Likewise, Friday’s relatively rosy employment data doesn’t give us the complete picture. For example, federal employees who took the government’s “deferred resignation” offer are still getting paid, and therefore, are still counted as employed. That means the full extent of DOGE layoffs is yet to be revealed.

We’ll begin seeing the true effects of tariffs on employment in the coming weeks, but we won't have a grasp of GNP for the current quarter (which ends in June) until July.

If what I've been reading is correct, China stopped filling container ships several weeks back. That means the West Coast ports will soon become COVID-like. It also means the supply chain may be broken, once again, with the triple threat of recession, loss of jobs, and inflation.

This summer may be memorable for all the wrong reasons.

I don’t think anyone is really taking in how catastrophic this situation is. I feel it is dire and am trying not to panic. If you step back and look at the big picture it’s terrifying. The loss of tourism and the ripple effect, the destruction of research in government and at universities and ripple effects, international students are not coming, destruction of government departments,SSI is going to collapse, empty ports, empty shelves, job losses and this is just the beginning. The world is cutting us out. This is very, very bad.