Yesterday, the Trump administration introduced what it called its “reciprocal” tariff scheme. While corporate CEOs—and the financial markets—were braced for a targeted policy, what they received instead was a global excise tax. The result Trump’s economic hubris was a financial calamity that obliterated $2 trillion of Wall Street wealth in a single day.

CNBC economist Steve Liesman struggled to explain a situation that was orders of magnitude beyond market participant’s worse case scenarios. John Aravosis, who publishes the Aravosis Report on TikTok, broke down the absurd mathematical formula that Team Trump used:

And not for nothing, the whole idea of “bringing manufacturing back to America” is a pipe dream tailor-made for MAGA audiences. As Duke Corporate Education’s Dr. Rebecca Holmes explains, if it made economic sense to relocate back to the U.S., corporations would’ve done so following the supply chain collapse caused by the pandemic:

I’ve said before that Trump does not think of policy the way most of us do, operating instead like a low-level mob boss running a protection racket. Unfortunately, a bunch of rubes decided to give him another bite at the apple, and now the entire global economy has to pay up:

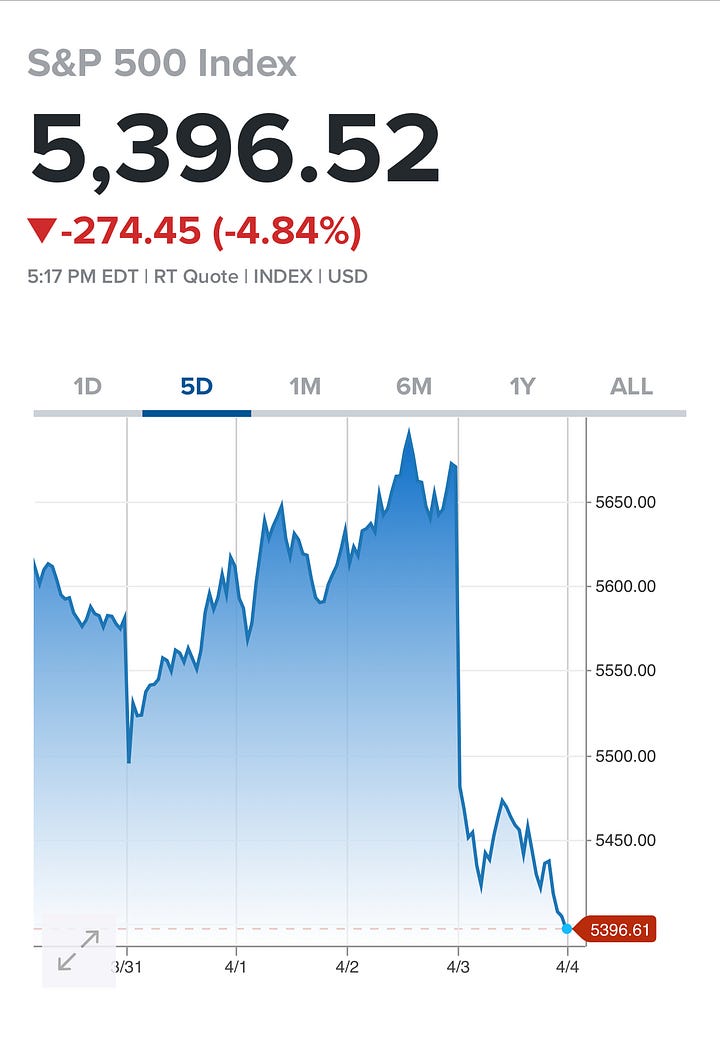

Dow Jones Industrials sank over 1600 points, S&P 500 and the NASDAQ had their biggest one-day losses since the pandemic era.

Apple lost roughly $312 billion of market capitalization. To put this into perspective, that’s nearly the entire market capitalization of Coca Cola.

According to Challenger and Christmas report on layoff announcements, more than 275,000 layoffs were announced last month, a level not seen since the pandemic. Of that number, almost 80% of total layoffs announced came from DOGE.

Legendary bond investor Bill Gross warned that folks should stay away from the markets and not “buy the dip,” comparing the day’s debacle to the day the U.S. went off the gold standard telling Bloomberg, “Investors should not try to ‘catch a falling knife’. This is an epic economic and market event similar to 1971 and the end of the gold standard except with immediate negative consequences.”

The baseline 10% tariffs go into effect April 5th on all imports to the United States, except for Canada and Mexico. What else happens on the 5th? That’s when the lifeline Trump threw TikTok at the beginning of the year expires. Amazon, Oracle are allegedly vying to buy the company, but don’t sleep on Jeff Yass, the billionaire owner of Susquehanna, who’s reportedly in the mix as well. The company’s stake in ByteDance is valued at about $30 billion.

One of the most baffling things about the last decade is how people talk themselves into it disregarding what Donald Trump says. Then, once he does what he has repeatedly said what he would do, they normalize the behavior, no matter how norm-breaking, illegal, or cruel.

Call it what you will, cognitive dissonance, suspension of disbelief, or downright delusion it is pervasive. Even the supposedly astute market participants have ignored Trump’s tariff threats. Take this quote from Charles Schwab—a global investment bank—shortly after Trump’s inaugural address:

The market seems to have decided that the bark is worse than the bite regarding the tariff threats—as we wrote was likely to be the case in our commentaries "Five Investing Impacts of a Trade War" and "2024 Elections: Big Bark, Little Bite."

The market might be right—but it's still early. Let's explore the potential reasons why the market may be unconcerned about the impact of any new tariffs.

No Day One tariffs enacted as had been pledged.

U.S. energy exports offered as a way for Europe and China to avoid tariffs.

The new political leadership in Europe and Canada are more like Trump, easing the path to cutting a deal.

Global trade survived Trump 1.0.

Last September, the Peterson Institute for International Economics (PIIE), a nonpartisan think tank, conducted a live-stream analysis of the impact of Trump’s economic proposals.

For those unfamiliar with the independent nonprofit, its founding chairman was Peter G. Peterson, who previously served on President Nixon's Council on International Economic Policy and as the administration's Secretary of Commerce. (Because of its connection to Peterson, the independent think tank is often confused with The Peter G. Peterson Foundation, a separate organization that also receives support from the Peterson Family.)

During the livestream, several members of the group presented the findings of its working paper, “The international economic implications of a second Trump presidency,” and let me tell you, its authors do not mince words:

Former president and Republican presidential candidate Donald Trump has campaigned on plans to increase tariffs and deport unauthorized immigrants, and he has said the president should have more influence over the Federal Reserve's monetary policy.

The authors find these policy changes would harm the US economy—causing higher US inflation and lower employment and GDP than otherwise would occur. The main sectors that would be hit are agriculture and durable manufacturing. Some of the world's economies would benefit by some measures, while others would be damaged but not as much as the United States.

According to the paper, the best-case scenario is that Trump’s tariff plan increases inflation by more than 4% by 2026. The worse case scenario would increase it by an additional 7.4%.

What was billed as Liberation Day will forever be remembered as Obliteration Day, one of the worst days for global financial markets in a generation. And for the umpteenth time, Trump has proved that he means everything he says.

Maybe now we’ll start believing him.

It is going where many thought. It will be bad, but maybe some people have to experience a bad choice. Hopefully, some will learn from mistakes!

I thought *maybe* he wouldn’t do the tariffs because he didn’t know how. I see he just made something up. Not surprising.