When Political Dogma Poses as Investment Strategy

In which the anti-woke brigade set its sights on investment methodologies

The other day I had a brief Twitter exchange with Mark Dow, a global macro trader. According to his profile on Business Insider, he was previously an economist at the U.S. Treasury Department and the International Monetary Fund.

The catalyst for Dow’s tweet was an Andrew Ross Sorkin interview with Ramaswamy on CNBC’s Squawk Box. Something Ramaswamy said during the interview triggered the following reaction from Dow:

Since I left the business over a decade ago, I rarely watch Squawk Box. That said, I still record every episode, if for no other reason than as an occasional trip down memory lane. So I queued up the latest episode and fast-forwarded to Ramaswamy’s interview to see what was up.

For the unfamiliar, Vivek Ramaswamy is an ex-biotech entrepreneur turned asset manager. He’s also the author of Woke, Inc.: Inside Corporate America’s Social Justice Scam. It’s fair to say that he’s the influencer du jour among a rising tide of anti-anti-racism and anti-woke crusaders.

He and others in this nascent movement think asset managers — BlackRock, Vanguard, and State Street specifically — push “woke” investment methodologies like Environmental, Social, and Governance, or ESG, which favors green technologies. According to Ramaswamy, they’re forcing their liberal ideology on defenseless investors. Conveniently, he’s here to save the world from Wall Street liberalism gone wild.

Don’t get me wrong; there are plenty of reasons for concern regarding the power the so-called “Big Three” investment funds wield on behalf of their clients. But being too “woke” ain’t one of them. This summer, Vanguard became the largest holder of 330 stocks in the S&P 500 — almost 70% of the index. BlackRock, the world’s largest asset management company, manages over $8 trillion in client assets. But the idea that they’re part of some woke cabal? Come on.

That said, Ohio-born Ramaswamy sings the song many on the right want to hear. As an East Asian American, his status as a person of color makes him a valuable asset in the diversity-challenged Republican ecosystem. That he also rails against “identity politics” is music to GOP (read MAGA) ears.

Indeed, there is a lucrative market on the right for persons of color with conservative leanings. The ascendency of Candace Owens within the Republican media hierarchy is a prime example of what I call “the diversity arbitrage.”

A couple of years before switching to the conservative team, Owens, whose husband George Farmer is the CEO of Parler, the far-right social media company, was on the other side of the political spectrum, running a Trump-bashing publication.

Unlike Owens, the Harvard-educated Ramaswamy’s carefully packaged message of anti-wokeness-as-investment-strategy allows him to play to both CNBC and CPAC audiences.

He’s all the rage in the conservative media circuit, with regular appearances on Fox News, Fox Business, and right-leaning CNBC. This summer, he appeared at CPAC’s annual meeting alongside Steve Bannon and Viktor Orban, the authoritarian prime minister of Hungary.

Ramaswamy’s anti-woke investment message has also caught fire with the Republican mega-donor class. Earlier this year, he launched Strive Asset Management, an anti-ESG investment fund.

The fund is bankrolled by a cadre of notable investors, including Peter Theil, the GOP mega-donor who also lends his largesse to Blake Masters and J.D. Vance in their respective senate campaigns.

You must hand it to the guy; he does a stellar job of obfuscating the full extent of what he’s really pedaling. It takes enormous cajónes to market oneself as the savior who wants to take politics out of finance while simultaneously taking money from one of the biggest Republican donors on the planet.

The rise of Ramaswamy’s Strive, which eschews investing in clean technologies in favor of energy companies, seems remarkably convenient. In trading parlance, there’s more money to be made by taking the other side of the ESG trade.

What’s the big deal with ESG, anyway?

Understanding why Ramaswamy et al. believe ESG is part of a radical far-left agenda requires some explanation. In a white paper I wrote a few years back, I described environmental, social, and governance investment methodology, or ESG:

ESG is an investment methodology factoring in a variety of issues and their impact. This investment approach, also referred to as sustainable, responsible, and impact (SRI) investing, represents one-fifth of all investments under professional management.

In the past, ESG focused primarily on social issues, but in the aftermath of the financial crisis, investors and asset managers increased the focus on corporate responsibility and hidden risks...

According to the US SIF Foundation, institutional investors, money managers, and community investing institutions held assets of $8.10 trillion to which they applied ESG criteria into their investment analysis.

The trend favoring the avoidance of short-term thinking as well as a desire to understand better the potential systemic threats has made climate change a top ESG priority.

The anti-ESG movement is the latest arrow in the Republican culture war quiver. The view asserts that the investment strategy is part of a plot by Wall Street forces to impose a radical leftist ideology on investors instead of focusing on profits.

The right views investment considerations such as climate risk assessment as wokeness run amok. For a party whose stock-in-trade is wedge issues rather than policy, anti-ESG dogma is just what the doctor ordered.

For example, this summer Florida banned its pension fund managers from considering ESG methodologies in their investment decisions. Around the same time, the comptroller for the state of Texas banned BlackRock, Credit Suisse, and BNP Paribas from doing business in the state for allegedly boycotting energy companies.

In July, West Virginia did the same thing, giving BlackRock, Goldman Sachs, and JP Morgan & Co. the boot, accusing their ESG strategies of damaging the state’s economy. Earlier this month, two states with Republican treasurers gave us a glimpse of what lies ahead.

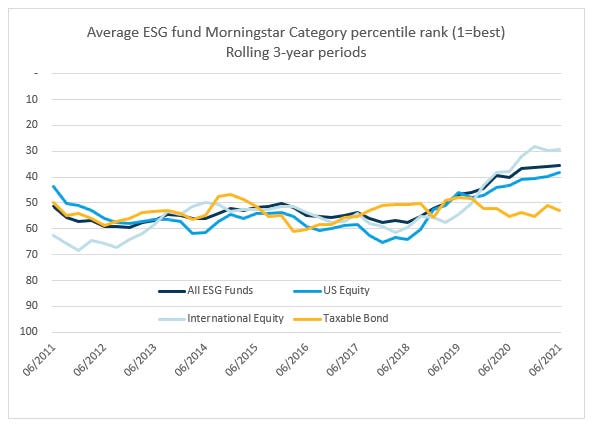

The State of Missouri recently snatched $500 million of pension assets managed by BlackRock for the alleged crime of “prioritizing” ESG over investment returns. A few weeks before that, Louisiana announced plans to pull $794 million from BlackRock, for the same reason. But here’s the rub: according to the data, the anti-ESG movement’s entire raison d'etre — that the strategy is nothing more than virtue signaling — could be a solution in search of a problem, according to a 2021 report from Charles Schwab:

ESG funds have consistently ranked around the middle of their peer groups—sometimes a bit below the middle, sometimes a bit above, but never dramatically worse. If ESG funds were at a natural disadvantage, these lines would be toward the bottom of the chart. If anything, ESG funds have done a bit better than average overall, especially recently (though this isn't a strong effect)…

…The important lesson here is that there is no evidence that choosing ESG funds puts investors at any kind of disadvantage when it comes to risk or returns.

Bottom line: If the concept of socially responsible investing appeals to you, our research has found that you should not have to reduce your expectations when it comes to risk and return. ESG funds have done as well as other funds over time…

And not for nothing, but ESG and climate investing are two of the fastest-growing parts of the investment industry, with clean energy stocks outperforming those of energy companies.

The Ramaswamy CNBC Interview

Although CNBC published the first half of this interview, they did not post the bonkers direction it took towards the end. The following is a transcript of the second half of the Andrew Ross Sorkin interview, lightly edited due to the level of crosstalk.

The first several minutes are garden variety CNBC. After some back and forth on oil vs. clean energy investing, Sorkin asks Ramaswamy his opinion on Saudi Arabia’s “Davos in the Desert” investor conference as it relates to the kingdom’s deteriorating relationship with the Biden administration.

Later in the conversation, Ramaswamy implies that paints Ye (aka Kanye West) as a victim since JP Morgan closed his accounts. Then things went go off the rails (emphasis added):

The thing that bothers me here is that you have a U.S. president who has to go hat in hand begging every foreign dictator around the world to produce more oil when we could be doing it more effectively right here at home. And Biden got slapped in the face not once but twice by MBS — first when he accidentally rehabilitated MBS on the global stage — keep in mind that this is a dictator who Biden said that he wanted to turn into a pariah, instead he has the inadvertent of legitimizing him on the global stage, while then getting slapped in the face one more time when OPEC Plus actually decides to cut production, and prices go up as a result.

Here is where I agreed with Ramaswamy, at least to a degree. I’ve long thought that the U.S. should re-evaluate its relationship with the Saudis, especially since this incident.

Word is that Biden is considering a moratorium on oil exports to drive down gas prices and use the current crisis as an opportunity to ramp up green energy production.

Given Ramaswamy’s response, Sorkin took the opportunity to flip the script:

SORKIN: If you don’t believe he [MBS] should be legitimized, then do you believe that those CEOs should not be going there as a boycott if you will against this country [Saudi Arabia]?

RAMASWAMY: I have my personal views as a citizen, Andrew, but I don't think it's the responsibility of companies to be the moral arbiters of international justice and I think part of the problem we inherit is that when companies claim that role for themselves that’s what renders their behaviors hypocritical whether it’s with China or whether it’s with Saudi Arabia. And I think our societal expectation should be one that says that companies should just focus on their products for profit without apologizing for it and that’s it.

SORKIN: But you've talked about it, about companies and the idea of being patriotic, the idea that here is a country that’s slapping us in the face. You talked about China slapping us in the face…

RAMASWAMY: My view is actually…I believe that citizens need to be more patriotic. And I think part of that is separating that from viewing companies as being patriotic or not. I think companies…to be clear about it, should focus on just delivering excellent products and services to customers for profit but the problem, the tripwire in that system Andrew is that when companies are able to claim that moral patina that they get from virtue signaling here at home. That allows them to come out of their international hypocrisies smelling like a rose.

At this point, Sorkin seems to smell blood, shifting the conversation to Addidas’s termination of the company’s relationship with Ye (formerly known as Kanye West) earlier that morning. This is where Ramaswamy reveals his game:

SORKIN: Ok, well then before we go then let’s talk about, and I don’t know if you think it’s moral patina or not, weigh in then on Addidas ending its agreement with Kanye over these anti-Semitic remarks. I would argue to you this is not a moral patina this is something that you have to do, and you have to, not just as a citizen, but as a corporate citizen of the world. Do you have a different view in that case?

RAMASWAMY: I’m not going to pick on necessarily Addidas cutting its ties with someone they think is or isn't good for its brand. I did have more of a problem though with JP Morgan Chase shutting down reportedly at least the bank accounts of Kanye West and terminating their customer relationship with them. At the end of the day, I think that if you can’t discriminate against somebody on account of their race or their sexual orientation or their gender I don't think you should be able to discriminate against them on account of their political beliefs either.

(Side note: As far as I’m aware, nobody has a problem with Ye’s politics, however misguided. The problem is his repeated habit of saying and doing things that are anti-Semitic, misogynistic, and anti-Black.)

At this point, CNBC host Becky Quick seems to reach the same conclusion as Mark Dow and jumps into the conversation:

QUICK: They were trashing JP Morgan. Vivek, they were trashing JP Morgan. You can’t cut relationships with the customer if they don’t like you and they go out and say nasty things about you?

SORKIN: I think even worse than that Kanye said he wanted to end his account with them. So I think they ended their account with him.

RAMASWAMY: So look, on the specific facts of it, if somebody wants to terminate their relationship that’s a two way relationship with respect to disparaging...

QUICK: [laughing] Those aren't the facts.

RAMASWAMY: …with respect to disparaging a partner. But I’m making a broader point.

QUICK: You're making a broader point not based on the facts of that case. So change your example.

RAMASWAMY: Yeah, we can change the example. I think the specifics of the Kanye West case change by the minute depending on what Kanye has or hasn’t said on a given day. But broadly I think the general principle is that companies that discriminate on the basis of race sex or national origin they’re not permitted to do that I think they take a…

SORKIN: But Vivek, do you believe if somebody makes a hateful anti-Semitic comment, or more than that in this instance, and I will accept that there are health issues bipolar disorder and other things taking place, but but nonetheless that a company should be able to say “enough with you?”

RAMASWAMY: I think that companies should have that freedom and I think that actually my preferred state of the world we don’t have these protected classes at all. I think that if we want to let the free market work we ought to let the free market work. But the point I’m making Andrew is ironically what’s happened over the last 50 to 60 years is that in the name of actually expansive civil rights jurisprudence where we said certain hostile workplace environments now count as violations on the race or gender prongs of the civil rights statutes. We’ve actually created the very culture that creates political discrimination in the workplace so we can’t have it both ways.

QUICK: Wait, wait, wait. Back up. I think you're kind of blurring the line here. If you make antisemitic comments…are are Jews are protected race that you don’t think should be protected?

RAMASWAMY: I absolutely…look, here’s what I think: either we trust the market to decide who they get to do business with and who they don’t. That businesses get to discriminate, and if businesses are sillily discriminating against one race that’s a great opportunity for another business to step up and hire those same people or work with those same customers.

[Laughter]

RAMASWAMY: Either we trust the free market or we actually apply those standards even handedly to say that they can’t discriminate against somebody…

QUICK: If JP Morgan decides they don’t wanna do business with somebody based on some nasty comments that they’re making against a class or a group of people, what’s it to you? That is the free market.

RAMASWAMY: Well, actually it's not the free market when you prohibit their ability to discriminate on the basis of religious beliefs so I don’t know why we treat religious beliefs any different than we treat political beliefs. So, my point is we have to apply these standards evenhandedly.

Strive’s stated mission is “to restore the voices of everyday citizens in the American economy by companies to focus on excellence over politics.” But it sounds as though Ramaswamy and his friends on the far right want investment decisions that suit their brand of politics.

Swami Ramalama Dingdong, like Tiny President Man is not beholden to truth or logic. On another note, he must still be stinging that he was Doge Dissed. That’s when two rich, powerful racists kick you out of their club and you have to walk around pretending they love you just the same.