Trump’s Empire has Entered a Death Spiral

The only way Trump can avoid financial ruin is by becoming president again

In the early eighties, I saw the eighth-ranked Arkansas Razorbacks play the Mustangs of Southern Methodist University, then the country's top-ranked college football team. My brother Orson was a starting tackle for the Hogs, but to be honest, I was also there to watch Eric Dickerson. A future NFL Hall of Fame running back, Dickerson was the exciting half of SMU’s “Pony Express.” Although the game ended in a tie, Dickerson still managed to leave the game as the leading rusher in Southwest Conference history.

In those days, SMU was a university that barely had 6,000 students, but the school had assembled a football team replete with some of the nation’s best athletes. But how? Why would Dickerson, a prospect considered by many to be the country’s best college prospect, withdraw his commitment to Texas A&M, to attend a no-name college? The answer was simple. SMU cheated. A lot.

To be fair, all the top colleges, including Arkansas, cheated a little. But SMU took rule-breaking to a different level. The running joke was that the school paid Dickerson so much money to play there when he was selected in the first round of the 1983 NFL draft, he took a pay cut.

SMU’s rule-breaking was so beyond the pale, that the NCAA finally brought the hammer down on the school's football program. The college football rule-making body gave the school a penalty so severe, it became known in the sports circles as “the death penalty.”

The school’s two-year suspension from football resulted in the collapse of a program that could only exist by breaking the rules. One could even argue that the end of the Pony Express era was the catalyst for the demise of the Southwest Conference.

Here is the part of this newsletter where I tell you that the more paid subscriptions The Journeyman has, the easier it is to keep it free to read for everyone. If you are able, please consider becoming a paid subscriber. To make it easier for you to say “yes!” from now through the end of April, paid subscriptions are 25% off. Forever!

Poor, unfortunate souls

For decades, Donald Trump took cheating in business to an audacious level. His behavior has been so egregious one could argue that The Trump Organization was the corporate equivalent of SMU’s football program. It’s only fitting that he and his business would suffer the same fate.

It’s been a long time coming, but the legal system dropped an NCAA-sized hammer on the Trump real estate empire last week. By the time it’s all said and done, the multimillion-dollar company Trump inherited from his father may suffer the same fate as SMU’s college football program.

Last week’s jaw-dropping verdict in the New York civil fraud case found the Trump Organization guilty of massive financial fraud. Arthur Engoron, the judge in the case, also ruled that the company’s leadership engaged in conspiracy and issued false business records and financial statements.

Judge Engoron fined former president Trump and his company $355 million for fraudulently inflating the values of its real estate holdings. Trump’s two adult sons were fined $4 million each, and his former chief financial officer received a fine of $1 million for a total judgment of $364 million.

While he stopped short of dissolving Trump’s businesses outright, Engoron barred the former president from serving as director of any New York company for three years. That, combined with the staggering fine could spell the end of the Trump Organization.

While the judgment is a body blow, that’s not the end of Trump’s financial problems. Because Engoron ruled that the Trump Organization fraudulently received lower-than-market interest for several loans, there is an additional pre-judgment interest penalty (PJI) from the inception of each fraudulent loan, totaling approximately $100 million.

The pre-judgment interest on $168 million, the dollar amount of loans in which Trump received lower than market interest, stretches from March 2019 to the present—at a rate of 9% per annum. For example, the PJI on the Old Post Office accrues from May 2022; the interest penalty from his $60M sale of Ferry Point Golf Course begins in June 2023.

F*ck you, pay me

The interest penalties on the New York civil fraud judgment equate to approximately $100 million. Trump must pay in cash or by securing a bond.

Last week, Judge Engoron denied Trump’s motion to delay payment while his legal team appeals the decision, which means the former president has until March 25th to pay the associated fines and interest penalties. Should Trump fail to satisfy the judgment on time, New York Attorney General Letitia James has indicated that she will petition the court for permission to begin seizing his assets.

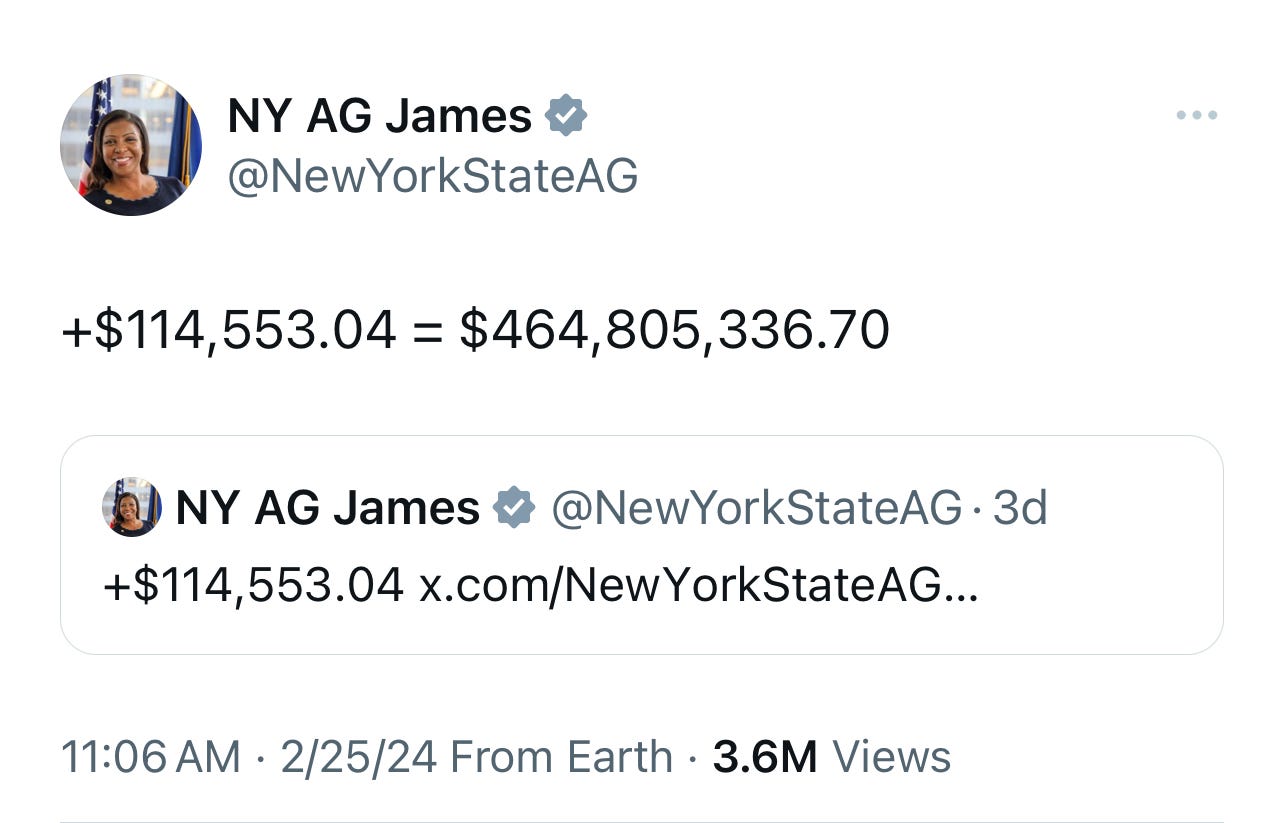

The amount Trump owes in the civil fraud case increases by $114,553.04 every single day. And to make sure Trump doesn’t forget, James has posted a running total of his ever-increasing debt on social media every day since the verdict.

In addition to the New York civil fraud judgment, Trump also owes just shy of $90 million for his two losses in the E. Jean Carroll sexual abuse and defamation cases, both of which he also plans to appeal. Trump put up cash with the court regarding the $5 million verdict, however, he has filed a motion to delay payment of the court's $83.3 million judgment while he appeals the decision.

Bloomberg estimates Trump may have as much as $600 million in cash, and he boasted in a deposition last year that he had $400 million in cash. But given his habit of lying—especially about his wealth—you’d be forgiven for not taking him at his word. Either way, it’s still not enough. The math just ain’t mathin’.

In the last two years, Trump has spent $76 million on lawyers—$50 million in legal fees in 2023 alone. According to Vanity Fair, Trump's Save America PAC, an entity Trump has depended on to cover his legal expenses, spent $3.9 million in January but only received $8,508 in donations that month. No wonder he wants to use the Republican National Committee’s coffers as his legal defense fund.

Trump is almost certain to lose millions, if not billions, unwinding his real estate portfolio to cover the cost of judgments, mounting legal bills, and a presidential campaign. According to New York Magazine, the timing couldn’t be worse for Trump:

Trump’s largest holding, by value, is a minority partnership with Vornado at 555 California Street in San Francisco — a commercial office building in a city experiencing a “doom loop.” Microsoft, a former tenant, is trying to dump its office space there, and a neighboring building recently saw its value plunge by 80 percent. If you go down the list of Trump’s other holdings in New York, much of what his name is attached to are similar properties, but through deals that are not as cut-and-dried as somebody just holding the title to a property. At 40 Wall Street, for instance, he owns a ground lease — that is, he pays the building’s owners, the wealthy German Hinneberg family, for the right to lease it out. Since commercial real estate is in the throes of a valuation crisis, if Trump has to start selling any of these assets, he’ll likely be handing someone a fire-sale deal.

It's difficult to imagine anyone under such a high level of financial distress gaining access to the levers of power.

And yet, the Republican Party believes Donald Trump, a man on the verge of financial ruin and under multiple criminal indictments, should be given the keys to the White House.

If you enjoy and want to support my writing, please consider signing up as a paid subscriber. You'll get access to all my posts, subscriber-only podcasts, occasional Zoom events, and the occasional subscriber-only chat.

Don't miss Jenifer Lewis's recent podcast comment aimed at people who cannot be bothered to VOTE.

I’d love to hear it. Can you provide a link?