The other day I made a run to the local Publix to replenish our supply of spring water. As I fetched the water jugs from my trunk, a man walked past me. The back of his T-shirt was decorated with the giant, smiling image of Donald Trump a the phrase, “Miss me yet?” The message implied that, during the Trump administration, things were much better than they are now.

The quote is reminiscent of Ronald Reagan's iconic, “Are you better off than you were four years ago?” a version of which Republicans resurfaced this election season. Realizing that four years ago, things were dramatically worse, they revised the quote to five years to sidestep Trump’s disastrous handling of the pandemic.

But as I wrote in mid-2020, the economy was beginning to roll over a full year before the pandemic:

When the BLS [the Bureau of Labor Statistics] releases economic reports, they usually contain revisions to the prior month, due to the accumulation of additional data over time. The May BLS release contained a significant revision for April. From February 16th to March 14th, the economy lost 1.4 million jobs before the lockdowns even started…

…Indeed, over eight years of monthly job gains going back to October 2010 came to a halt in February 2019, nearly a year before the pandemic started. That month, the economy lost 50,000 jobs.

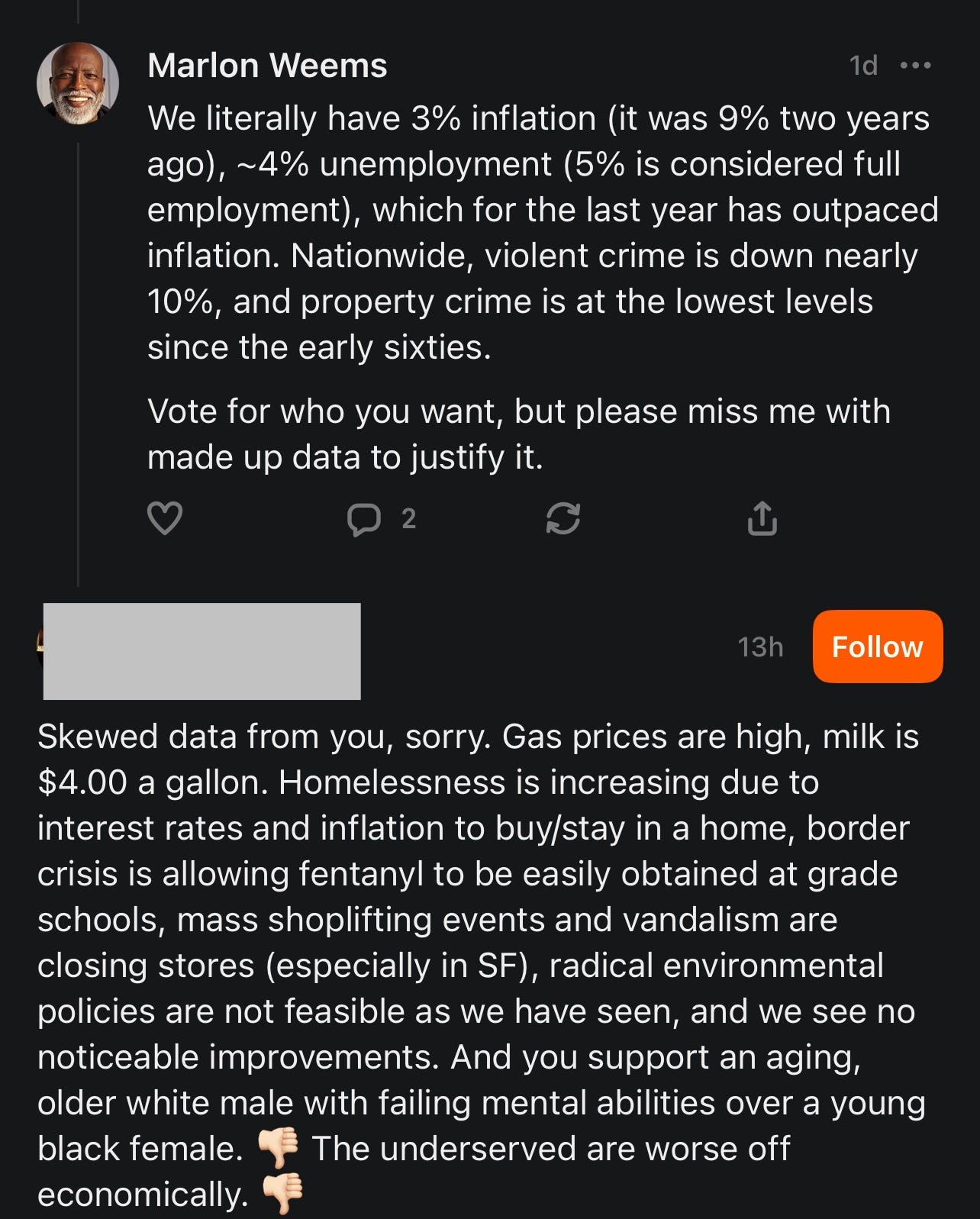

Over the last several years, I’ve had numerous conversations with people like the guy wearing the Trump T-shirt. Trump’s long history of racism, misogyny, and dozens of felony convictions aren’t a dealbreaker for these folks. They do not care that he instigated an insurrection, or that he won’t commit to accepting the results in November if he loses. Moreover, they are not interested in factual data or incontrovertible facts. Whenever I engage with them regarding the economy, it eventually goes like this:

Not long ago, I had an exchange with a paid subscriber who also happens to be a Trump supporter. This person made a valiant effort to convince me that the Democratic Party has done a terrible job on the economy. When I suggested that, since this was my area of expertise, I might be better informed, he questioned the nature of my “expertise.”

It occurred to me that beyond a few posts about my time in the financial sector, I haven't written much about what I did in my former career. So here goes.

Life before the beach

Before I opted for what folks in my neck of the woods refer to as “The Salt Life,” I spent over thirty years in a variety of finance roles, starting in Arkansas. In the mid-nineties, I started the state's first Black-owned investment bank and later moved to Manhattan.

On Wall Street, I ran trading desks at several boutique (Wall Street code for small) investment firms. Even in a diverse city like Manhattan, I still was one of the only African Americans to run a trading desk. My last job as a head trader was at an algorithmic trading desk for an affiliate of Cantor Fitzgerald. (Howard Lutnick, Cantor's CEO, recently held a fundraiser for Trump. They say it didn't go well).

A lot of folks have the mistaken impression that trading securities only involves buying and selling. But clients with billions to invest expect a person running a trading desk—even a small one—to have an above-average knowledge of how the economy works. Early on, I had the benefit of learning the basics of economic theory from in-house economists at the places where I worked.

When economic reports like unemployment or CPI were released, clients expected me to interpret the impact of that information. I didn’t need to be perfect, but if I couldn’t explain a BLS release, then bye-bye trading business. By the time I got to Wall Street, I’d been analyzing economic data for trading clients for fifteen years.

After moving to North Carolina, I started a one-person consulting business. Small investment firms paid me $500 an hour to advise them on how to make their trading desks more competitive.

I also consulted as a subject matter expert for one of the top capital markets research firms in New York. So when a global investment firm needed a report written on the latest fintech trend, a financial information provider needed a white paper on high-frequency trading technology, or a joint venture wanted an analysis of the trading environment in Brazil, the research firm hired me to write the report.

My work in that area has been cited in books on financial capitalism, and elsewhere in academia. The Cato Institute cited my work in an analysis of financial regulation policy which, given my politics, is kind of weird.

The last freelance project I did was an extensive report analyzing use cases for blockchain technology in the healthcare industry. Since then, I've focused on this newsletter, and finishing a manuscript that has taken much longer to complete than I anticipated.

The point of this little humblebrag isn’t to suggest that I was a big deal on Wall Street. There are probably thousands of people (mostly white men) with similar resumes. I do, however, hope it explains that when I write about finance and the economy, I have more than a passing knowledge of how it all works.

With that said, let’s drill down on Trump’s economic performance as president, and some of the policies we can expect if he's reelected. But first, I’d be remiss if I didn’t mention last Tuesday’s debate.

She Came, She Saw, She Kicked His A$$

From the moment Kamala Harris forced Donald Trump to shake her hand, the debate was over. Just as she did with Jeff Sessions, Bret Kavanagh, and Bill Barr as a senator, Harris totally knocked Trump off his game.

I never expected to see another performance as bad as Joe Biden's debate debacle—especially not in the same election cycle. But after letting it simmer for a couple of days, I think the way Kamala Harris dismantled Donald Trump was much worse than Biden’s collapse. After all, Trump should have seen this coming.

For days leading up to the debate, the Harris campaign telegraphed that their strategy was to bait Trump, which is exactly what happened. When Harris figuratively punched him in the nose, instead of punching back with policies, Trump fell headfirst into Harris’ trap.

In one exchange after another, Harris exposed Trump as little more than an angry old has-been who spends way too much time traveling down conspiracy rabbit holes. Had it been a heavyweight prize fight, the referee would've stopped it.

I'll leave it to others to fact-check Trump on his infanticide and pet-eating migrant claims. But let's talk about his past performance and his current policy proposals.

Trump's economy vs. Biden’s

Some of you may be familiar with Steve Rattner. For those who aren't, he's the guy who occasionally appears on MSNBC’s “Morning Joe” program, always accompanied by a variety of economic charts displayed on several big screens.

What you may not know is that Rattner is the chairman and CEO of the asset management firm that invests Michael Bloomberg’s billions. He was also the Obama administration’s “car czar” (not to be confused with the nonexistent “border czar”). Rattner led the effort to save General Motors and the rest of the automobile industry during the Great Financial Crisis.

Following the Trump-Biden debate, Rattner appeared on the program to debunk several of Trump’s assertions regarding his administration's economic performance. Using a side-by-side analysis adjusted for the pandemic, Rattner gives a great analysis of Trump’s assertions about migrant crime, so-called “bounce-back jobs," and tax cuts.

Weaving a tangled web

Recently, at an event sponsored by the Economic Club of New York, Trump was asked to discuss his childcare policy. He responded with one of the most incoherent strings of gibberish I've ever heard. If I started babbling like this, my wife would call an ambulance.

When I worked in New York, I attended a lot of speaker events like the one at the New York Economic Club, although none featured U.S. presidents. Trump's audience is comprised of some of the most well-educated, well-informed groups one could assemble. They must've known that what he was saying was utter nonsense. How they could applaud Trump's drivel is just shameful.

The mainstream media has generously interpreted Trump's word salad to mean that huge tariffs will pay for child care, something that is virtually impossible. As Rattner explained earlier today, a tariff is levied on the importer of foreign goods, who passes that expense on to the consumer. The exporting countries don’t pay a dime.

Since the countries Trump wants to impose tariffs upon will undoubtedly respond with tariffs on our products, the inevitable result of this policy will be a dramatic increase in inflation, and since our products will become more expensive in other countries, the collapse of our export industry.

Don’t believe me? Here's what happened when Trump enacted a similar policy on China during his previous tenure as president (emphasis added):

Government payments to farmers have surged to historic levels under President Donald Trump as the Agriculture Department floods the industry with cash to stem the financial losses from Trump’s tariff fights and the coronavirus pandemic…

…Direct farm aid has climbed each year of Trump’s presidency, from $11.5 billion in 2017 to more than $32 billion this year — an all-time high, with potentially far more funding still to come in 2020, amounting to about two-thirds of the cost of the entire Department of Housing and Urban Development and more than the Agriculture Department’s $24 billion discretionary budget…

The spending surge began in mid-2018 when USDA started writing checks to farmers and ranchers to pay for the damage from Trump’s trade war, which brought about higher tariffs that crushed agricultural exports and commodity prices. Farm sales to China plummeted from $19.5 billion in 2017 to just $9 billion the next year; as producers continued to hemorrhage profits in 2019, farm bankruptcies jumped nearly 20 percent last year [2019].

This is literally stuff one learns in high school. Despite being a less-than-stellar student, I recall learning about the Smoot-Hawley Tariff Act in 10th-grade history. Widely regarded as one of the worst tariff policies ever legislated, it made the Great Depression even worse. Trump has floated the idea of replacing federal taxes with across-the-board tariffs. It's as though he’s attempting to outdo Smoot-Hawley.

Trump has also proposed removing taxes on Social Security benefits. While this makes for a great sound byte, removing taxes from Social Security is just a back door way to speed up the program’s insolvency.

With policies like these, it’s no wonder Goldman Sachs, no bastion of progressivism, predicts a Harris/Walz administration will be better for the economy, or Moody’s Analytics predicts that a Republican sweep will result in accelerated inflation.

The most common rationalization I've heard from those who plan to vote for Trump is some version of, “I like his policies.” Who knows, maybe the guy I saw at Publix was an undercover billionaire, one of the few still benefiting from the Trump tax cuts.

But I suspect that, deep down, most of his supporters know they are voting against their own interests. Whatever their reasons for still supporting Trump, it isn’t because his policies are good for them.

It makes me crazy when people cling to the misperception that Republicans are better on the economy. Democrats have to pull the country out of recessions caused by the Rs and get blamed for all of the problems.