Last Friday while most of the country was engaged in hand-wringing over the fate of TikTok, House Budget Committee Republicans were busy constructing their wishlist of options and cost estimates for the Party's reconciliation package.

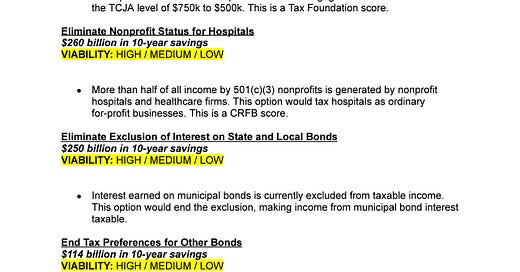

Everything seems to be on the table, including the mortgage interest deduction, tax-exempt status of municipal bonds, the…